Backgrounding Calves: Navigating Price Risks with the BCRC Calculator

When feeder and calf prices are expected to rise, it can be tempting to hold onto this year’s calves and background them, especially if you’ve got the feed on hand. But as we saw last year, markets can shift quickly—heavier carcass weights offset the lower slaughter numbers, keeping prices under pressure. In addition, current weakness in the futures market makes it difficult to predict what to expect for future prices. Price uncertainty is something to keep in mind when deciding whether to sell calves this fall or carry them longer.

“Should I sell or background my calves?”

Evaluating whether it will be profitable to background calves rather than sell them at weaning includes both performance risk and price risk. Factors to consider include current calf prices, cost of gain (feed and yardage), projected feeder prices, animal performance and interest rates. These will vary for each beef producer, depending on their cattle and cost structure; therefore, each operation needs to crunch its own numbers.

Performance risk comes from the uncertainty of how calves will perform. Price risks come from changing price levels and slide related to weight gain.

Using the BCRC’s Preconditioning & Backgrounding Calculator

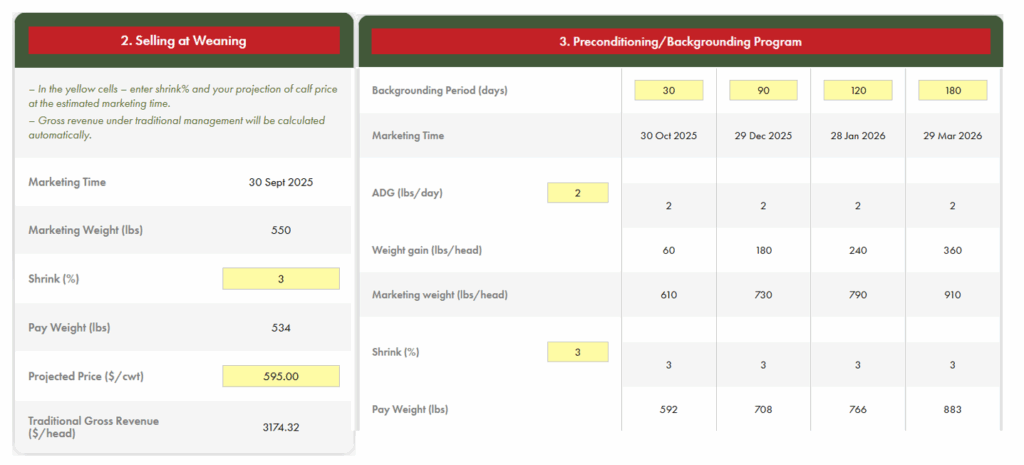

The Beef Cattle Research Council’s (BCRC) Preconditioning & Background Calculator allows for a direct comparison between selling calves at weaning and four backgrounding scenarios, which can be customized for your operation. The tool’s design allows for a quick comparison between all options.

In years where a price rally is occurring, such as 2023, there was limited seasonality to feeder prices. In this scenario, it paid off to hold feeder cattle longer. However, seasonal trends re-entered the marketplace in 2024. Looking at how prices usually move through the year can give you another way to gauge where the market might be headed.

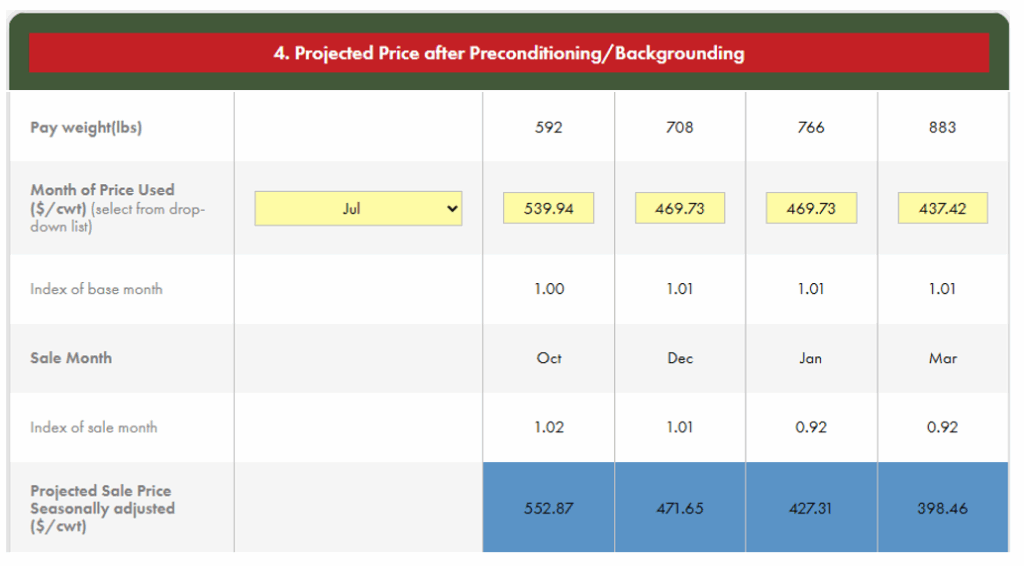

The BCRC’s Preconditioning & Backgrounding Calculator has been updated based on the Alberta five-year index to include the most recent average (2019-23). The model is designed to project prices based on current pricing levels (Figure 1, yellow boxes) to reflect the current market conditions.

Figure 1. Backgrounding calculator showing projected sale price based on seasonally adjusted projected sales prices

Seasonality vs. Futures

This analysis is based on the following assumptions:

- Shrink: 3% on weight

- Weaning weight: 550 lbs

- Projected price at weaning: $595/cwt

- Average daily gain: 2 lbs/day

- Feed costs: $2.02/head/day (works out to about $1.01 per lb of gain)

- Vet & medicine: $26.28/head

- Yardage (including labour): $0.65/head/day

- Death loss: 3%

- Marketing costs: $20/head

- Interest: 5.95% (Prime rate + 1%)

- Price basis: Alberta cattle prices

- Barley: $270/tonne for the full feeding period

Looking at the cost of backgrounding calves for 30, 90, 120, and 180 days (see Figure 2), the numbers reflect typical costs but may vary depending on your own interest rate, feed and yardage situation.

Figure 2. Assumptions of the backgrounding calculator

Producers using this calculator should input their current interest cost, as interest rate impacts overall profitability. Interest rate in this calculator is based on the Prime Rate on August 20, 2025, plus 1%. This calculator will be more effective overall when numbers for your operation are used, when compared to the default numbers.

The following scenarios use the above assumptions to demonstrate how changing projected calf weight gain or using the futures market compared to seasonal trends may impact the calculator results.

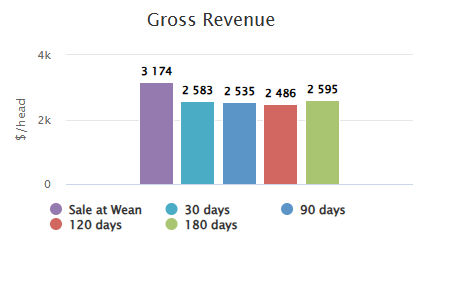

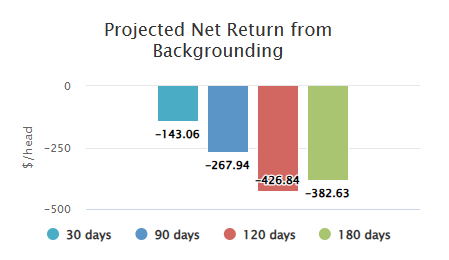

Scenario 1: Five-year Seasonality Index, 2 lbs ADG

Using the five-year seasonal index, projected prices were estimated for all four time periods (the last week of October, December, January and March) based on a September 30 weaning date, and an August monthly average price of $595/cwt. This price is then used in the BCRC Preconditioning and Backgrounding Calculator. The five-year seasonal index shows a negative net return estimated for all backgrounding periods.

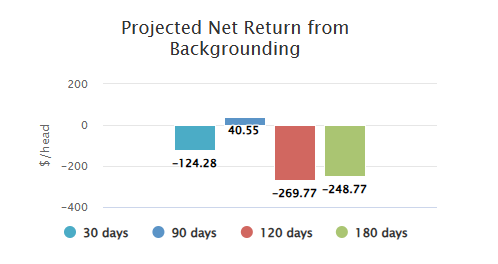

Scenario 2: Five-year Seasonality Index, 3 lbs ADG

When average daily gain (ADG) increases to 3 lbs/day, a shift occurs in the backgrounded period that is estimated to have positive net returns. In this scenario, a 90-day backgrounding period is projected to have a small positive return. This is partially driven by the price slide between 700-799 lb cattle and 800-899 lb cattle.

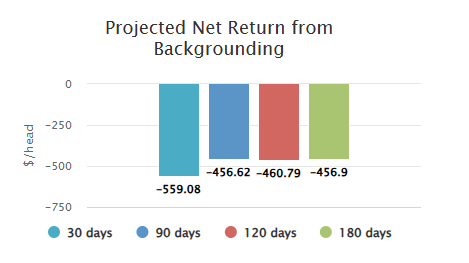

Scenario 3: Using the Futures, Exchange Rate and cost of gain to Project Prices, 2 lbs ADG

Using the CFX Pro App, projected prices were estimated for all four time periods, based on the futures, exchange rate and cost of gain. These prices were then input into the BCRC Preconditioning & Backgrounding Calculator. Net returns were negative for all four feeding periods. Larger losses were estimated on calves preconditioned for 30 days compared to the other time periods.

Key Highlights

- Overall, net returns are negative, though the five-year seasonal index is more optimistic than the futures market.

- Change in weight and price slide plays a role when increasing weight gain through the backgrounding period.

Ultimately, inputting your own records into the BCRC’s Preconditioning & Backgrounding Calculator will help you make decisions on the profitability of retaining calves on your farm.

lEARN MORE:

Sharing or reprinting BCRC posts is welcome and encouraged. Please credit the Beef Cattle Research Council, provide the website address, www.BeefResearch.ca, and let us know you have chosen to share the article by emailing us at [email protected].

The BCRC is funded by a portion of the Canadian Beef Cattle Check-Off.

Your questions, comments and suggestions are welcome. Contact us directly or spark a public discussion by posting your thoughts below.