To Sell or Background Calves? – Introducing the BCRC Backgrounding Calculator

“Should I sell or background my calves?” is a question most cow-calf producers face every year. Producers need to project whether it will be profitable to feed their calves on a backgrounding program rather than sell them at weaning. There are many deciding factors including current calf prices, cost of gain, and projected feeder prices. These variables are all different for each producer, depending on their cattle, and their cost structure, therefore each operation needs to crunch their own numbers.

The Beef Cattle Research Council’s new Backgrounding Calculator can help make the decision. This decision-making tool is designed to identify economic opportunities and risks from backgrounding cattle.

Risks and Rewards of Backgrounding

Retaining ownership or backgrounding can give cow-calf producers greater market flexibility and additional revenue through heavier marketing weight. By retaining ownership, producers can also reap the benefits of the investments they have made in their calves through genetic selection, as well as other preconditioning-related practices like low-stress weaning. On the other hand, producers will have higher cost through added feed and labour, as well as higher price and performance risks.

Price risk comes from a change in the general price level and slide related to weight gain. A price slide is a phenomenon where cattle prices, often expressed in dollar per hundredweight ($/cwt), tend to decrease as an animal’s weight increases. The magnitude of the price drop is affected by feed grain prices. In general, when feed grains are relatively inexpensive, cattle feeders see more incentives to turn cheap feed into beef and are willing to pay more for light-weight cattle. When feed grains are expensive, it makes more sense to put as many pounds as possible on the cattle before they reach the feedlot, which supports heavier-feeder prices and encourages backgrounding.

Performance risk comes from the uncertainty of how calves will perform. Average daily gain, total pounds gained, feeding efficiency, and death loss can have a big impact on the cost of gain during the backgrounding period. If the typical performance of calves is unknown, backgrounding can be disappointing with a higher cost of production than planned. Having the facilities, labour and expertise to address the production risk is critical to being successful.

Using the Backgrounding Calculator

Producers can use the BCRC Backgrounding Calculator to project profit opportunity of backgrounding versus selling at weaning. This tool will calculate the net returns from backgrounding, which is the difference between the gross revenue from selling cattle at weaning compared to gross revenue after a backgrounding period, minus the total backgrounding cost. The tool considers the performance and price risks by including average daily gain, shrink rate and death loss information, and price adjustment due to weight change and market seasonality.

Net Return from Backgrounding

| + | – |

|---|---|

| Revenue from additional marketing weight | Backgrounding costs |

| Lower price per pound on heavier weight | |

| Feeder price seasonal adjustment |

Producers can enter information on cattle performance, backgrounding costs, and calf and feeder prices in the yellow cells, then compare up to three customized backgrounding periods.

Future feeder prices are projected based on a five-year index with both Alberta and Ontario historical prices. It is important to note that this historical price index provides a baseline for price projection, however a number of factors such as the cattle supply situation, the live and feeder cattle futures, basis levels, the Canadian dollar, and feed costs, can affect feeder prices. For more information on price projection, check out the free Canfax app CFX Pro.

Scenarios and Results

The below examples demonstrate how to use the Backgrounding Calculator, and how prices and performance affect backgrounding decisions and results.

The potential net return from backgrounding a steer calf weaned at 550 lbs in mid-October in Western Canada are evaluated for three backgrounding periods (90, 120 and 150 days). Three scenarios and their assumptions are outlined below, however producers can use their personalized on-farm numbers to determine more accurate results.

Scenario 1 – Baseline

Price Assumptions: Calf and feeder prices are at the five-year (2016-2020) average levels. Assume August cattle prices are the most current prices available when making decision. The Canfax five-year average steer prices in August are used for calculation (Table 1).

Table 1. Canfax Five-year Average Steer Prices in August ($/cwt)

| 4-500 lb | 5-600 lb | 6-700 lb | 7-800 lb | 8-900 lb | 900+ lb |

|---|---|---|---|---|---|

| $222.70 | $213.50 | $204.70 | $198.00 | $188.70 | $180.10 |

Cattle Performance Assumptions: Average daily gain is at 3lb/day. Shrink rate is 5% at weaning and 3% after backgrounding.

Backgrounding Cost Assumptions: Feed cost is at $2.40/day/head, medicine and veterinary care at $16/head, labour and equipment at $0.50/day/head, interest rate at 3.45%, death loss at 1% and additional marketing costs at $17/head.

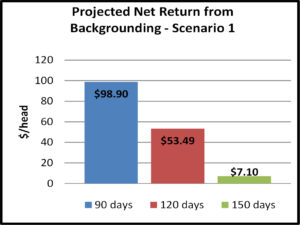

The results in Table 2 below show that under these assumptions, all three backgrounding periods are projected to be profitable compared to selling calves at weaning. The 90-day option has the highest net return with the smallest price decline related to heavier marketing weight and seasonal adjustment.

Table 2. Scenario 1 Results – Baseline

| 90 days | 120 days | 150 days | |

|---|---|---|---|

| Projected Sale Date | 13-Jan | 12-Feb | 14-Mar |

| Pay Weight (lbs) | 795 | 883 | 970 |

| Projected Sale Price ($/cwt) | $192.77 | $178.82 | $167.29 |

| Gross Revenue at Weaning ($/head) | $1,115.54 | $1,115.54 | $1,115.54 |

| Backgrounding Gross Revenue ($/head) | $1,533.26 | $1,578.47 | $1,622.68 |

| Total Backgrounding Cost | $318.82 | $409.44 | $500.04 |

| Net Return from Backgrounding($/head) | $98.90 | $53.49 | $7.10 |

| Breakeven Selling Prices ($/head) | $1,434.36 | $1,524.98 | $1,615.58 |

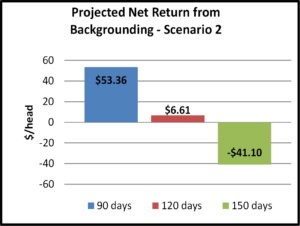

Scenario 2 – Weaker Feeder Prices

In this example, we impose greater price risk on feeder cattle. Calf prices are assumed to be steady while feeder cattle prices drop 3% from the baseline scenario to represent a market that favors lighter-weight cattle. In this case, the 150-day option is projected to result a loss of $41/head compared to sell at weaning, while the net returns from the 90 and 120-day options remain positive but significantly smaller than the baseline scenario with a decline of $46/head and $47/head respectively (See Table 3).

Table 3. Scenario 2 Results

| 90 days | 120 days | 150 days | |

|---|---|---|---|

| Projected Sale Date | 13-Jan | 12-Feb | 14-Mar |

| Pay Weight (lbs) | 795 | 883 | 970 |

| Projected Sale Price ($/cwt) | $186.98 | $173.46 | $162.27 |

| Gross Revenue at Weaning ($/head) | $1,115.54 | $1,115.54 | $1,115.54 |

| Backgrounding Gross Revenue ($/head) | $1,487.26 | $1,531.12 | $1,574.00 |

| Total Backgrounding Cost | $318.36 | $408.96 | $499.56 |

| Net Return from Backgrounding($/head) | $53.36 | $6.61 | -$41.10 |

| Breakeven Selling Prices ($/head) | $1,433.90 | $1,524.50 | $1,615.09 |

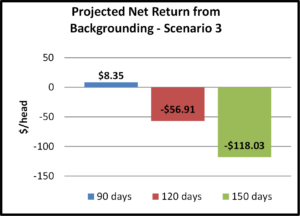

Scenario 3 – Lower Average Daily Gain, Higher Death Loss

In this example, we impose greater performance risk with average daily gain down from 3lb/day to 2.5lb/day, and an increase in death loss from 1% to 1.5%. Other variables remain the same with the baseline scenario. This results in lower marketing weights (down 43-73 lbs) and higher backgrounding cost (up 1-2%). As shown in Table 4, losses are projected for the 120 and 150-day options. The 90-day option remains profitable, but the net return shrinks significantly to $8/head. This means any addition price or performance risk could easily put the net return to a negative level.

Table 4. Scenario 3 Results

| 90 days | 120 days | 150 days | |

|---|---|---|---|

| Projected Sale Date | 13-Jan | 12-Feb | 14-Mar |

| Pay Weight (lbs) | 752 | 825 | 897 |

| Projected Sale Price ($/cwt) | $192.77 | $178.82 | $167.61 |

| Gross Revenue at Weaning ($/head) | $1,115.54 | $1,115.54 | $1,115.54 |

| Backgrounding Gross Revenue ($/head) | $1,449.12 | $1,474.39 | $1,503.88 |

| Total Backgrounding Cost | $325.23 | $415.77 | $506.37 |

| Net Return from Backgrounding($/head) | $8.35 | -$56.91 | -$118.03 |

| Breakeven Selling Prices ($/head) | $1,440.76 | $1,531.31 | $1,621.91 |

Backgrounding decisions should be based on current calf prices, cost of gain, and projected feeder prices. These variables are all different for each producer, depending on their cattle and their cost structure, therefore each operation needs to use their own specific values. Producers should continually monitor prices and input costs throughout the feeding period as these factors change, to ensure cattle are marketed at the optimum time. In addition, farmers should consider the potential tax and financial implications of retaining ownership and discuss their decision with their accountants. Producers may also consider using price insurance or contracting with a feedlot. By using risk management tools and price projections, producers can try and optimize the rewards of backgrounding cattle while balancing their risks.

Click here to subscribe to the BCRC Blog and receive email notifications when new content is posted.

The sharing or reprinting of BCRC Blog articles is welcome and encouraged. Please provide acknowledgement to the Beef Cattle Research Council, list the website address, www.BeefResearch.ca, and let us know you chose to share the article by emailing us at [email protected].

We welcome your questions, comments and suggestions. Contact us directly or generate public discussion by posting your thoughts below.